使用LogisticRegression和LightGBM模型对信贷违约进行预测----基于kaggle比赛数据

3.分离数值型变量与类别型变量,发现有些数值型变量因为输入不规范,比如数值中含有字符(28_,_10000_等)被划分为类别型变量 ,比如 'Age','Annual_Income','Num_of_Loan', 'Num_of_Delayed_Payment', 'Changed_Credit_Limit','Credit_Mix','Monthly_Balance', 'Outstanding

本人处于学习摸索阶段,文中错误难免,欢迎指正。

数据预测整体思路:

本文使用LogisticRegression建模对信贷业务进行违约预测,考虑该模型对变量的要求主要有:

1.变量之间不应存在较强的线性相关性和多重共线性

2.变量具有显著性:变量对应的系数P值,P值越小越好

3.变量具有合理的业务含义,符合风控逻辑:从系数的符号判定

4.缺失值和异常值对变量的影响较大

基于以上要求,对数据进行梳理,具体做法如下:

(一)数据预处理

1.了解数据自带的字典解释,查看数据整体特征,删除没有业务含义的变量。

2.分离数值型变量和类别型变量,部分数值型变量存在输入不规范问题

3.使用sql处理不规范输入问题

4.使用箱线图查看数值型变量分布的合理性,处理异常值

(二)数据相关性分析

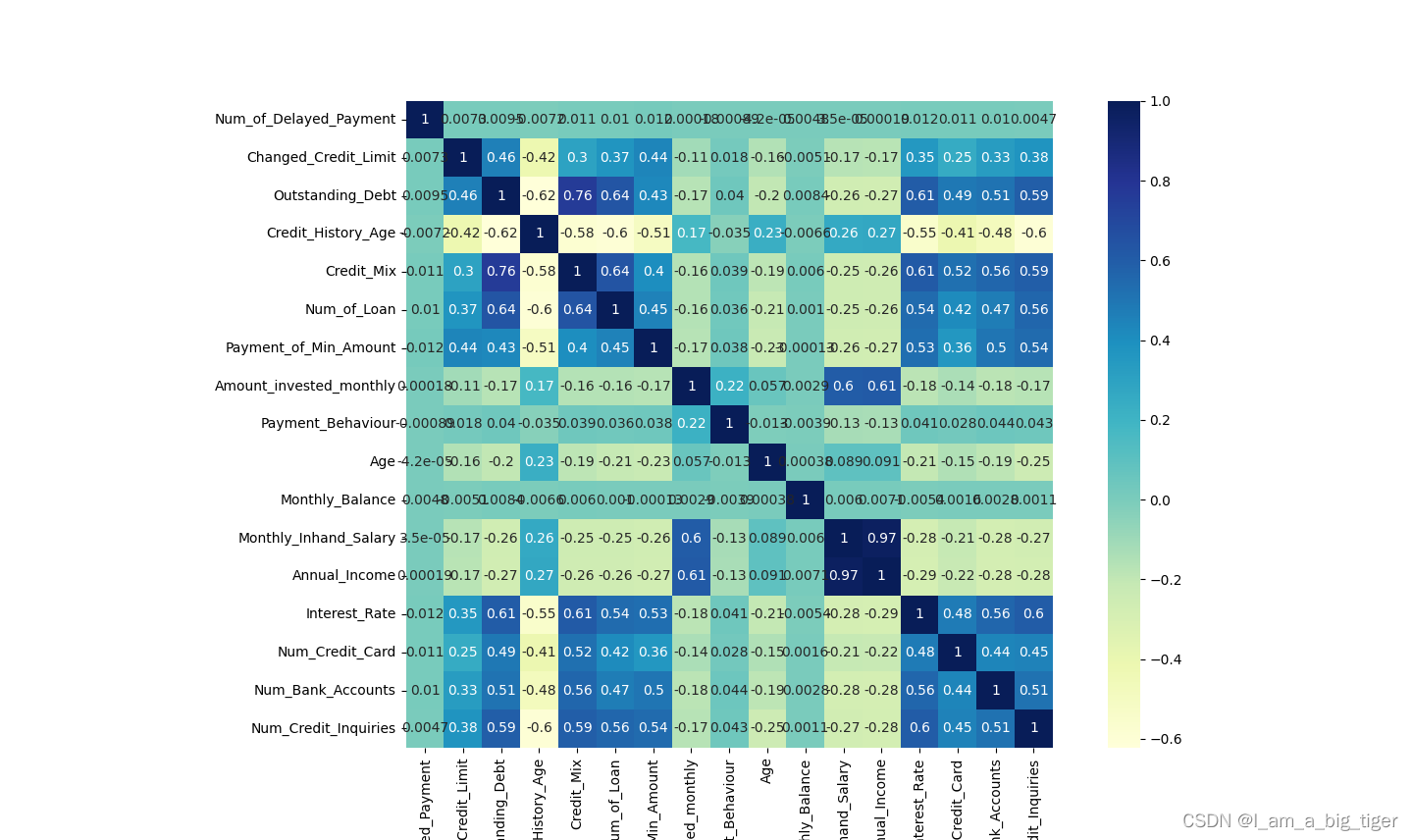

1.线性相关性分析,使用pearson计算相关系数,相关性大于0.6的特征,使用pearsonr查看p值。

2.使用逐步回归法(stepwise regression)查看特征之间的共线性,筛选并删除具有多重共线性的变量,本文使用这种方法对特征做筛选。

(三) 变量分箱,woe编码,iv值计算

1.变量分箱:特征分箱也是连续特征离散化,将连续性的特征进行分段,使其变成一个个离散的区间,离散化的特征对异常值有很强的鲁棒性,降低了模型过拟合的风险。首先根据woe的单调性查看合适的分箱区间,确定好分箱区间,对变量进行分箱、编码、计算iv值。

2.根据特征iv值,再一次筛选特征。

(四)模型训练,评估模型效果

1.模型划分为训练集和测试集

2.使用AUC和KS对模型效果进行评估

一、数据整体情况

1.数据读取:共有28个特征,100000行 ,同一个客户有多条业务记录,预测每一条记录违约情况

import pandas as pd

import numpy as np

data = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train.csv")

print(data.columns)

print(data.shape)Index(['ID', 'Customer_ID', 'Month', 'Name', 'Age', 'SSN', 'Occupation',

'Annual_Income', 'Monthly_Inhand_Salary', 'Num_Bank_Accounts',

'Num_Credit_Card', 'Interest_Rate', 'Num_of_Loan', 'Type_of_Loan',

'Delay_from_due_date', 'Num_of_Delayed_Payment', 'Changed_Credit_Limit',

'Num_Credit_Inquiries', 'Credit_Mix', 'Outstanding_Debt',

'Credit_Utilization_Ratio', 'Credit_History_Age',

'Payment_of_Min_Amount', 'Total_EMI_per_month',

'Amount_invested_monthly', 'Payment_Behaviour', 'Monthly_Balance',

'Credit_Score'],dtype='object')

2.查看数据基本情况,部分变量中含有空值,删除没有用的特征:Name,SSN(社会保险号码)

print(data.info())

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 100000 entries, 0 to 99999

Data columns (total 28 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 ID 100000 non-null object

1 Customer_ID 100000 non-null object

2 Month 100000 non-null object

3 Name 90015 non-null object

4 Age 100000 non-null object

5 SSN 100000 non-null object

6 Occupation 100000 non-null object

7 Annual_Income 100000 non-null object

8 Monthly_Inhand_Salary 84998 non-null float64

9 Num_Bank_Accounts 100000 non-null int64

10 Num_Credit_Card 100000 non-null int64

11 Interest_Rate 100000 non-null int64

12 Num_of_Loan 100000 non-null object

13 Type_of_Loan 88592 non-null object

14 Delay_from_due_date 100000 non-null int64

15 Num_of_Delayed_Payment 92998 non-null object

16 Changed_Credit_Limit 100000 non-null object

17 Num_Credit_Inquiries 98035 non-null float64

18 Credit_Mix 100000 non-null object

19 Outstanding_Debt 100000 non-null object

20 Credit_Utilization_Ratio 100000 non-null float64

21 Credit_History_Age 90970 non-null object

22 Payment_of_Min_Amount 100000 non-null object

23 Total_EMI_per_month 100000 non-null float64

24 Amount_invested_monthly 95521 non-null object

25 Payment_Behaviour 100000 non-null object

26 Monthly_Balance 98800 non-null object

27 Credit_Score 100000 non-null object

dtypes: float64(4), int64(4), object(20)

memory usage: 21.4+ MB

3.分离数值型变量与类别型变量,发现有些数值型变量因为输入不规范,比如数值中含有字符(28_,_10000_等)被划分为类别型变量 ,比如 'Age','Annual_Income','Num_of_Loan', 'Num_of_Delayed_Payment', 'Changed_Credit_Limit','Credit_Mix','Monthly_Balance', 'Outstanding_Debt' ,'Amount_invested_monthly'等

Nu_feature = list(data.select_dtypes(exclude=['object']).columns)

print('数值型变量:',Nu_feature)

Ca_feature = list(data.select_dtypes(include=['object']).columns)

print('类别型变量:',Ca_feature)数值型变量: ['Monthly_Inhand_Salary', 'Num_Bank_Accounts', 'Num_Credit_Card', 'Interest_Rate', 'Delay_from_due_date', 'Num_Credit_Inquiries', 'Credit_Utilization_Ratio', 'Total_EMI_per_month']

类别型变量: ['ID', 'Customer_ID', 'Month', 'Name', 'Age', 'SSN', 'Occupation', 'Annual_Income', 'Num_of_Loan', 'Type_of_Loan', 'Num_of_Delayed_Payment', 'Changed_Credit_Limit', 'Credit_Mix', 'Outstanding_Debt', 'Credit_History_Age', 'Payment_of_Min_Amount', 'Amount_invested_monthly', 'Payment_Behaviour', 'Monthly_Balance', 'Credit_Score']

4.预处理思路:先将不规范的输入统一处理,因自身使用习惯,此部分使用SQL处理,将特征Age、Annual_Income、Num_of_Delayed_Payment、Outstanding_Debt中的不规范字符去掉,将Credit_History_Age时间统一取年,Credit_Score 和Credit_Mix 01处理。

select *,replace(Age,'_','') Age_1,

replace(Annual_Income,'_','') Annual_Income_1,

replace(Num_of_Delayed_Payment,'_','') Num_of_Delayed_Payment_1,

replace(Changed_Credit_Limit,'_','') Changed_Credit_Limit_1,

replace(Outstanding_Debt,'_','') Outstanding_Debt_1,

left(Credit_History_Age,2) Credit_History_Age_1,

case when Credit_Mix='Good' or Credit_Mix='Standard' then 0

when Credit_Mix='Bad' then 1 else null end as Credit_Mix_1,

char_length(Type_of_Loan)- char_length(replace(Type_of_Loan,',','')) + 1 Num_of_Loan_1,

case when Payment_of_Min_Amount='NO' or Payment_of_Min_Amount='NM' then 0

when Payment_of_Min_Amount='Yes' then 1 end as Payment_of_Min_Amount_1,

replace(Amount_invested_monthly,'__10000__','') Amount_invested_monthly_1,

case when Credit_Score='Standard' or Credit_Score='Good' then 0 else 1

end as Credit_Score_1

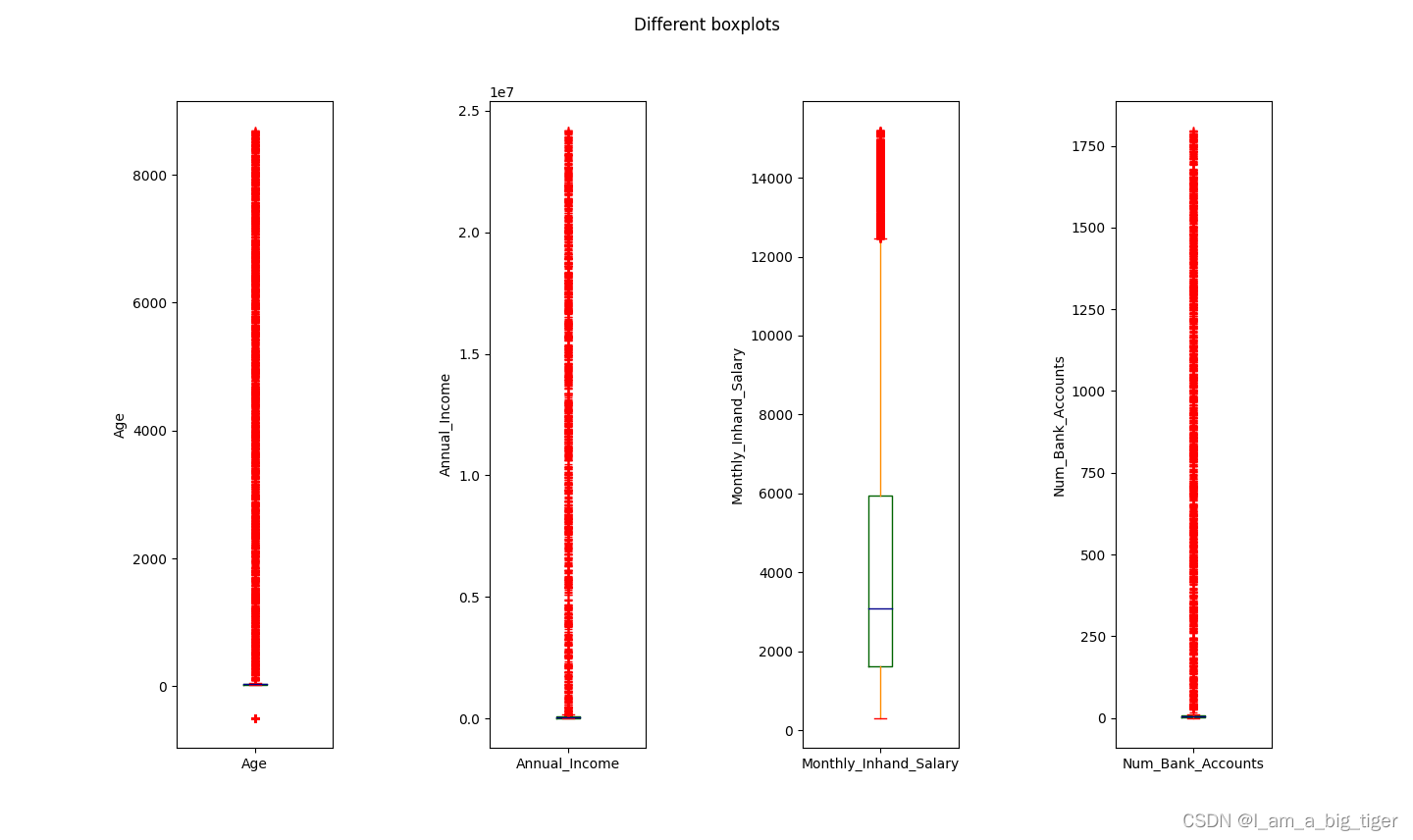

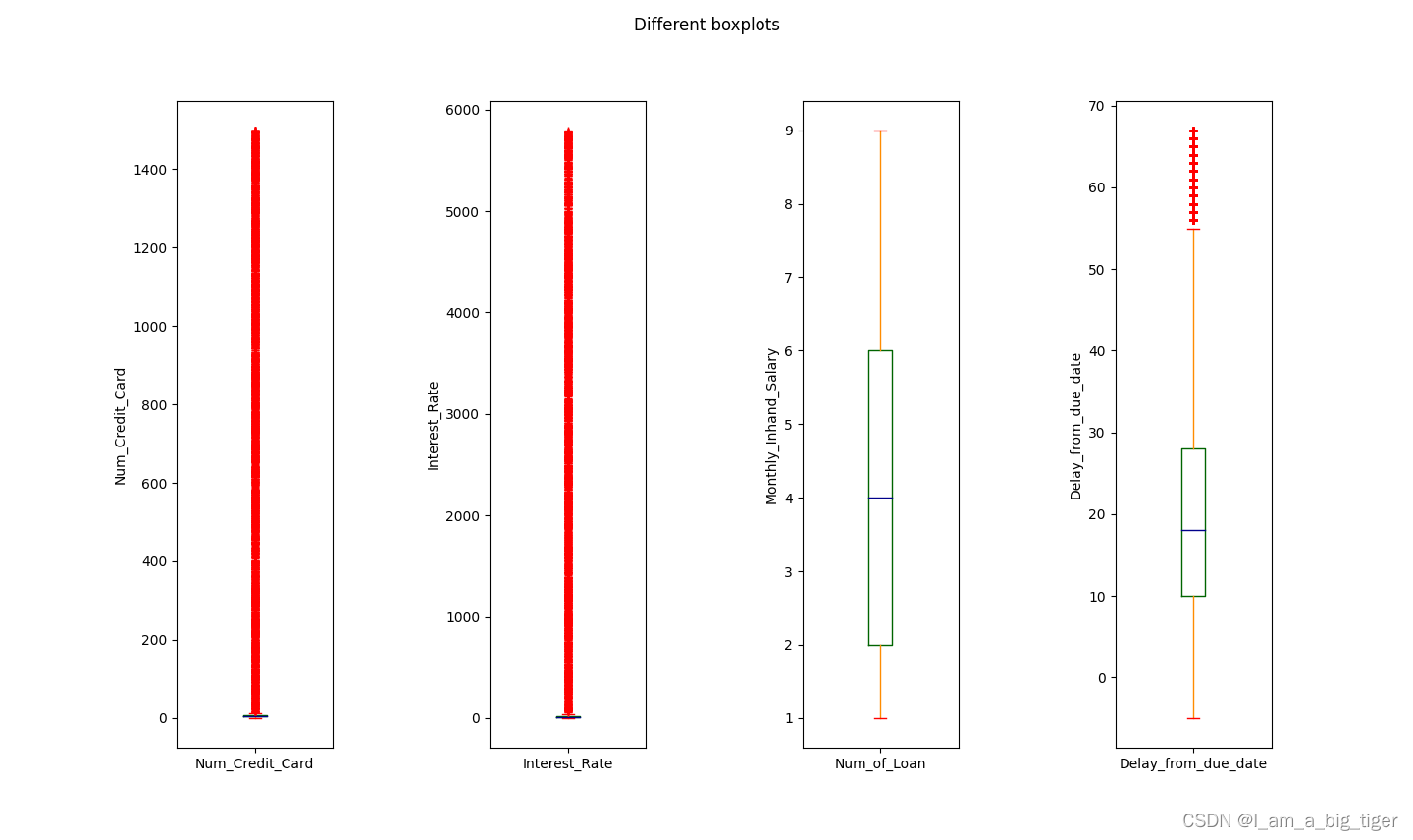

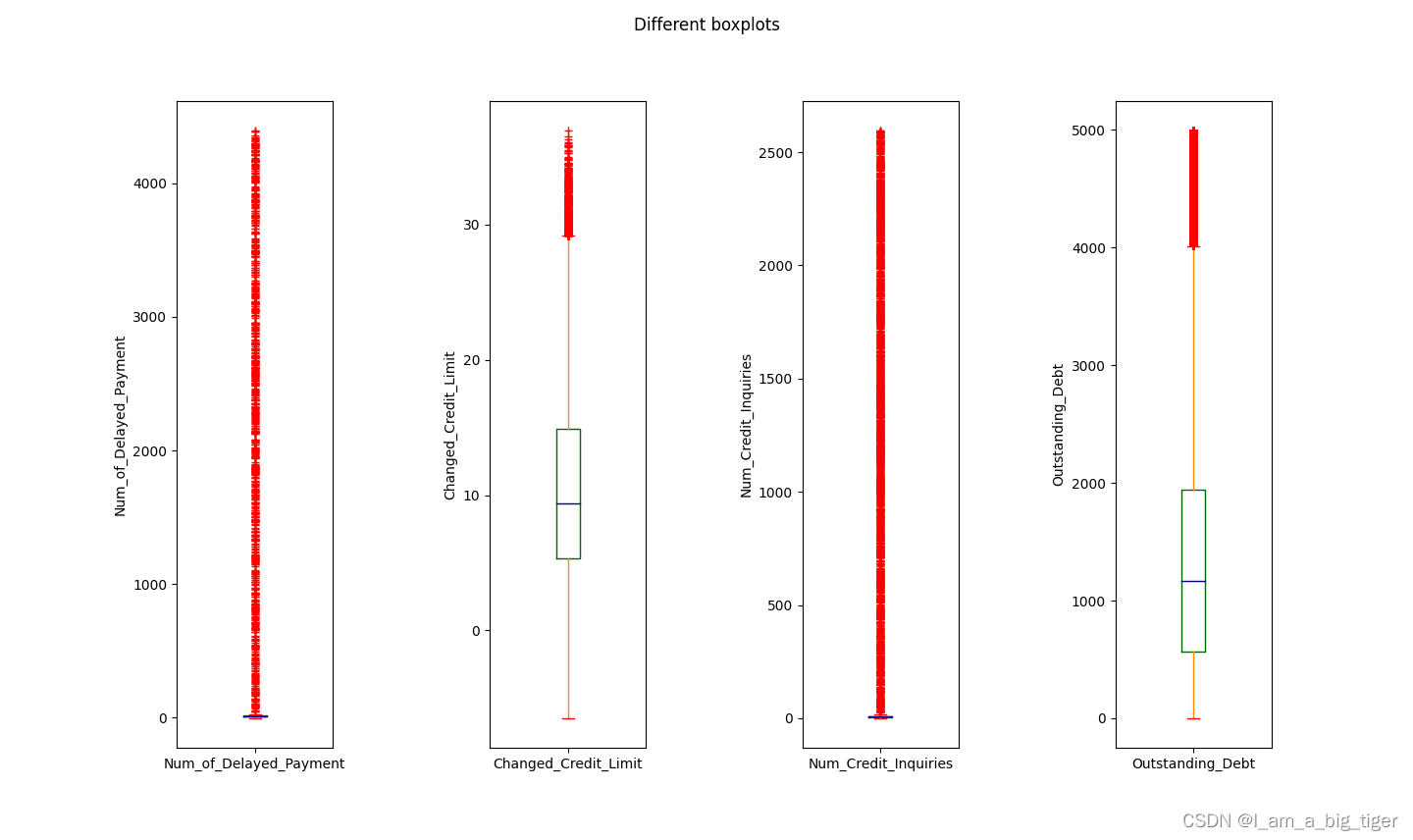

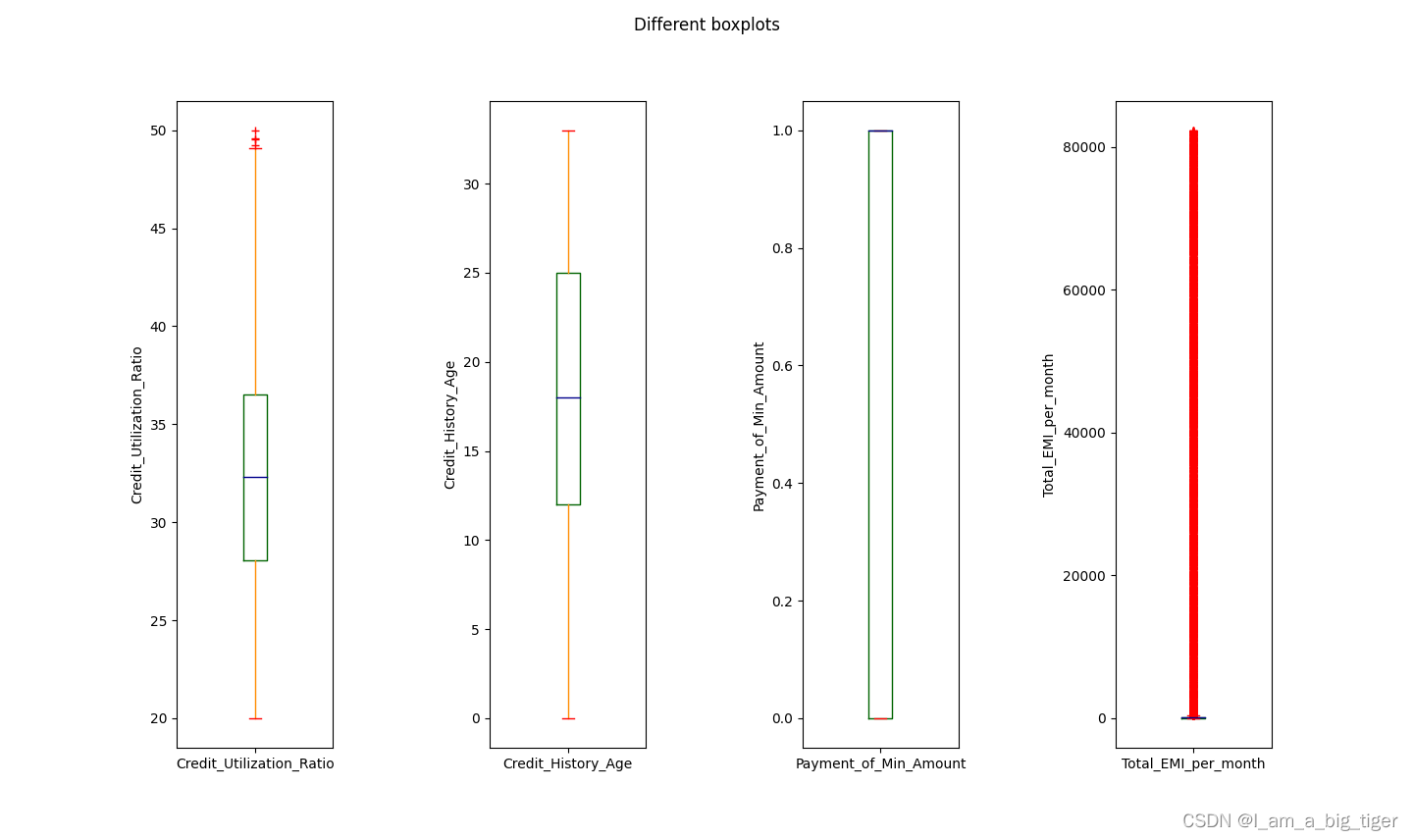

from train;5.查看规范之后的数值型特征统计值,画箱线图分析数值分布特征及合理性。通过箱线图,可以对变量的异常值有一个比较合理的判断,比如年龄,存在负值以及甚至上千的值,年收入和月收入可以结合起来看,存在异常大值,银行卡数量以及信用卡数量存在不合理的极大值,利率存在异常值,逾期天数从数值分布上存在极大值,但业务角度应是合理的。

##数值型变量统计基本情况

for col in Nu_feature:

print(col,':',data[col].describe())

6.根据箱线图分析,对不同特征变量异常值处理采用不同的方式:Age将负值和大于100的值变为空值;综合考虑月收入和年收入,将年收入大于200000变为空值,依次对变量的范围进行设定。之所以变为空值,主要是考虑存在同一个客户(Customer_ID)有多条业务(ID)记录,因此可以使用相同客户id的数据来填充。使用SQL处理异常值。

select case when Age <0 or Age >100 then null else Age end as Age,

case when Annual_Income >200000 then null else Annual_Income end as Annual_Income,

case when Interest_Rate>200 then null else Interest_Rate end as Interest_Rate_1,

case when Num_Credit_Card>20 then null else Num_Credit_Card end as Num_Credit_Card,

case when Num_Bank_Accounts<0 or Num_Bank_Accounts> 20 then null else Num_Bank_Accounts

end as Num_Bank_Accounts_1,

case when Num_Credit_Inquiries>50 then null else Num_Credit_Inquiries end as Num_Credit_Inquiries

from train;7.先查看经过上一步处理之后数据的缺失情况。下一步处理思路,Credit_Mix 使用随机森林方法缺失值填充,Age,Monthly_Inhand_Salary,Num_of_Loan ,Credit_History_Age,Amount_invested_monthly ,Num_of_Delayed_Payment,Changed_Credit_Limit , Num_Credit_Inquiries,Monthly_Balance 等等使用同一个客户其他不缺失的值来填充。

##查看各个特征缺失率

data = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train_1.csv")

missingDf = df.isnull().sum().sort_values(ascending=False).reset_index()

missingDf.columns = ['feature','missing']

missingDf['per-missing'] = missingDf['missing']/df.shape[0]

print(missingDf)feature missing per-missing

0 Credit_Mix 20195 0.20195

1 Monthly_Inhand_Salary 15002 0.15002

2 Num_of_Loan 11408 0.11408

3 Credit_History_Age 9030 0.09030

4 Amount_invested_monthly 8784 0.08784

5 Num_of_Delayed_Payment 7002 0.07002

6 Changed_Credit_Limit 2091 0.02091

7 Num_Credit_Inquiries 1965 0.01965

8 Monthly_Balance 1200 0.01200

9 Credit_Utilization_Ratio 0 0.00000

10 Payment_Behaviour 0 0.00000

11 Total_EMI_per_month 0 0.00000

12 Payment_of_Min_Amount 0 0.00000

13 ID 0 0.00000

14 Outstanding_Debt 0 0.00000

15 Customer_ID 0 0.00000

16 Delay_from_due_date 0 0.00000

17 Interest_Rate 0 0.00000

18 Num_Credit_Card 0 0.00000

19 Num_Bank_Accounts 0 0.00000

20 Annual_Income 0 0.00000

21 Age 0 0.00000

22 Credit_Score 0 0.00000

8.异常值补充方法:使用下一条数据补充异常值

'''

----异常值填充:用下一条值填充

Age,Monthly_Inhand_Salary,Num_of_Loan ,Credit_History_Age,Amount_invested_monthly ,

Num_of_Delayed_Payment,Changed_Credit_Limit , Num_Credit_Inquiries,Monthly_Balance

'''

data['Age'].fillna(method='bfill', inplace=True)

data['Monthly_Inhand_Salary'].fillna(method='bfill', inplace=True)

data['Num_of_Loan'].fillna(0,inplace=True) # 没有债务的用0填充

data['Credit_History_Age'].fillna(method='bfill', inplace=True)

data['Amount_invested_monthly'].fillna(method='bfill', inplace=True)

data['Num_of_Delayed_Payment'].fillna(method='bfill', inplace=True)

data['Changed_Credit_Limit'].fillna(method='bfill', inplace=True)

data['Num_Credit_Inquiries'].fillna(method='bfill', inplace=True)

data['Monthly_Balance'].fillna(method='bfill', inplace=True)

data['Num_Credit_Card'].fillna(method='bfill', inplace=True)

data['Interest_Rate'].fillna(method='bfill', inplace=True)

data['Num_Bank_Accounts'].fillna(method='bfill', inplace=True)

data['Annual_Income'].fillna(method='bfill', inplace=True)9.随机森林填充异常值。到此数据基础处理完毕。

'''

Credit_Mix 特征处理:

---用Credit_Mix 特征值非空的样本构建训练集,用缺失的样本构建测试集

'''

from sklearn.ensemble import RandomForestRegressor

data = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train_2.csv")

rfDf = data.iloc[:,[8,2,3,4,5,6,7,9,10,11,12,13,14,15,16,17,18,19,20,21]] ##原始数据集中的无缺失数据特征

rfDf_train = rfDf.loc[rfDf['Credit_Mix'].notnull()]

rfDf_test = rfDf.loc[rfDf['Credit_Mix'].isnull()]

##划分训练数据和标签(Label)

X = rfDf_train.iloc[:,1:]

y = rfDf_train.iloc[:,0]

##训练过程

rf = RandomForestRegressor(random_state=0,n_estimators=20,max_depth=3,n_jobs=-1)

rf.fit(X,y)

##预测过程

pred = rf.predict(rfDf_test.iloc[:,1:]).round()

df.loc[(df['Credit_Mix'].isnull()),'Credit_Mix'] = pred

print(df['Credit_Mix'].describe())

data.to_csv(r"D:\new_job\KAGGLE\kaggle\train_3.csv")二、相关性分析,特征筛选

1.计算皮尔逊相关系数,相关性大于0.6的特征,查看显著性,显著性小于0.05,认为显著。对于相关性大于0.6且关系显著的特征,保留其中区分性好、稳定性强的一个。

'''计算皮尔逊相关系数'''

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import pearsonr

data = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train_3.csv")

cor = data.columns[3:]

cor = list(cor)

pearson_mat = data[cor].corr(method='pearson')

plt.figure(figsize=(20,15))

sns.heatmap(pearson_mat,square=True,annot=True,cmap='YlGnBu')

plt.show()

'''

查看变量之间的显著性

'''

print(data.columns)

r1,p_value1 = pearsonr(data['Annual_Income'],data['Monthly_Inhand_Salary'])

print(r1,p_value1) ##0.9744325673262497 0.0

r2,p_value2 = pearsonr(data['Credit_Mix'],data['Outstanding_Debt'])

print(r2,p_value2)

r3,p_value3 = pearsonr(data['Num_of_Loan'],data['Outstanding_Debt'])

print(r3,p_value3)

r4,p_value4 = pearsonr(data['Credit_Mix'],data['Num_of_Loan'])

print(r4,p_value4)

r5,p_value5 = pearsonr(data['Interest_Rate'],data['Outstanding_Debt'])

print(r5,p_value5)

r6,p_value6 = pearsonr(data['Interest_Rate'],data['Credit_Mix'])

print(r6,p_value6)

r7,p_value7 = pearsonr(data['Annual_Income'],data['Amount_invested_monthly'])

print(r7,p_value7)

r8,p_value8 = pearsonr(data['Monthly_Inhand_Salary'],data['Amount_invested_monthly'])

print(r8,p_value8)

r9,p_value9 = pearsonr(data['Credit_Mix'],data['Delay_from_due_date'])

print(r9,p_value9)

2.查看变量的多重共线性,使用逐步回归法(stepwise regression),筛选并删除引起多重共线性的方法。['Target', 'Credit_Utilization_Ratio', 'Num_of_Delayed_Payment', 'Credit_History_Age', 'Num_of_Loan', 'Age', 'Num_Credit_Card', 'Num_Bank_Accounts'],这些特征被留下。接下来的分析使用这些被保留的数据。

'''

使用逐步回归方法筛选并删除引起多重共线性的变量

'''

import toad

final_data = toad.selection.stepwise(data,

target=data.Target,

estimator='lr',

direction='both',

criterion='aic',

return_drop=False)

select_cols = final_data.columns

print(select_cols)三、分箱,woe编码,计算IV值

1.先定义一个分箱函数,先观察各特征分箱情况,查看分箱单调性,找到分箱区间。发现woe都具有较好的单调性,可以采用以上分箱区间。

from scipy import stats ##导入一个推断包

def optimal_bins(Y,X,n):

'''

:param Y: 目标变量

:param X:待分箱特征

:param n:分箱数初始值

:return:统计值,分箱边界值列表,woe,iv

'''

r = 0

total_bad =Y.sum() ##总的坏样本

total_good = Y.count()-total_bad ##总的好样本

##分箱过程

while np.abs(r)<1:

df1 = pd.DataFrame({'X':X,'Y':Y,'bin':pd.qcut(X,n,duplicates='drop')})

df2 = df1.groupby('bin')

r,p = stats.spearmanr(df2.mean().X,df2.mean().Y)

n=n-1

##计算woe和iv值

df3 = pd.DataFrame()

df3['min_'+X.name] = df2.min().X

df3['max_'+X.name] = df2.max().X

df3['sum'] = df2.sum().Y

df3['total'] = df2.count().Y

df3['rate'] = df2.mean().Y

df3['badattr'] = df3['sum']/total_bad

df3['goodattr'] = (df3['total']-df3['sum'])/total_good

df3['woe'] = np.log(df3['badattr']/df3['goodattr'])

iv = ((df3['badattr']-df3['goodattr'])*df3['woe']).sum()

df3 = df3.sort_values(by='min_'+X.name).reset_index(drop=True)

##分箱边界值列表

cut = []

cut.append(float('-inf'))

for i in range(1,n+1):

qua = X.quantile(i/(n+1))

cut.append(round(qua,6))

cut.append(float('inf'))

##woe值列表

woe = list(df3['woe'])

return df3,cut,woe,iv

##观察各特征分箱情况,例如

'Delay_from_due_date'

df_dfdd,cut_dfdd,woe_dfdd,iv_dfdd = optimal_bins(data.Target,data.Delay_from_due_date,n=10)

print(df_dfdd)min_Delay_from_due_date max_Delay_from_due_date sum total rate \

0 -5 7 1959 17275 0.113401

1 8 11 1898 13020 0.145776

2 12 15 2173 13474 0.161274

3 16 21 4560 15265 0.298723

4 22 27 4550 14769 0.308078

5 28 38 5021 12434 0.403812

6 39 67 8837 13763 0.642084badattr goodattr woe

0 0.067556 0.215712 -1.160983

1 0.065453 0.156643 -0.872643

2 0.074936 0.159165 -0.753301

3 0.157252 0.150770 0.042093

4 0.156907 0.143926 0.086360

5 0.173150 0.104406 0.505875

6 0.304745 0.069378 1.479901

2.分箱,woe编码,计算iv值,筛选变量,其他变量iv值大于0.02,Credit_Utilization_Ratio iv= 0.004521,删除。

'''定义分箱函数'''

def custom_bins(Y,X,binlist):

'''

:param Y: 目标变量

:param X: 待分箱特征

:param binlist: 分箱边界值列表

:return: 统计值,woe值,iv值

'''

r = 0

total_bad = Y.sum() ##总的坏样本

total_good = Y.count() - total_bad ##总的好样本

#等距分箱

df1 = pd.DataFrame({'X':X,'Y':Y,'bin':pd.cut(X,binlist)})

df2 = df1.groupby('bin',as_index=True)

r,p = stats.spearmanr(df2.mean().X,df2.mean().Y)

df3 = pd.DataFrame()

df3['min_' + X.name] = df2.min().X

df3['max_' + X.name] = df2.max().X

df3['sum'] = df2.sum().Y

df3['total'] = df2.count().Y

df3['rate'] = df2.mean().Y

df3['badattr'] = df3['sum'] / total_bad

df3['goodattr'] = (df3['total'] - df3['sum']) / total_good

df3['woe'] = np.log(df3['badattr'] / df3['goodattr'])

iv = ((df3['badattr'] - df3['goodattr']) * df3['woe']).sum()

df3 = df3.sort_values(by='min_' + X.name).reset_index(drop=True)

woe = list(df3['woe'])

return df3,woe,iv

'''自定义分箱区间如下'''

#原始特征

ninf = float('-inf')

pinf = float('inf')

cut_cur = [ninf, 28.052567, 32.305784, 36.496663, pinf]

cut_ndp = [ninf,6.0, 9.0, 11.0, 14.0, 16.0, 18.0, 21.0,pinf]

cut_cha = [ninf,12.0, 18.0, 25.0,pinf]

cut_nol = [ninf, 2.0, 3.0, 5.0,pinf]

cut_age = [ninf,24.0, 33.0, 42.0,pinf]

cut_ncc = [ninf,4.0, 5.0, 7.0,pinf]

cut_nba = [ninf,3.0, 5.0, 7.0,pinf]

##查看统计值、woe、iv

df_cur,woe_cur,iv_cur = custom_bins(data.Target,data.Credit_Utilization_Ratio,cut_cur)

df_ndp,woe_ndp,iv_ndp = custom_bins(data.Target,data.Num_of_Delayed_Payment,cut_ndp)

df_cha,woe_cha,iv_cha = custom_bins(data.Target,data.Credit_History_Age,cut_cha)

df_nol,woe_nol,iv_nol = custom_bins(data.Target,data.Num_of_Loan,cut_nol)

df_ir,woe_ir,iv_ir = custom_bins(data.Target,data.Interest_Rate,cut_ir)

df_age,woe_age,iv_age = custom_bins(data.Target,data.Age,cut_age)

df_ncc,woe_ncc,iv_ncc = custom_bins(data.Target,data.Num_Credit_Card,cut_ncc)

df_nba,woe_nba,iv_nba = custom_bins(data.Target,data.Num_Bank_Accounts,cut_nba)

'''woe编码'''

data['Credit_Utilization_Ratio'] = pd.cut(data['Credit_Utilization_Ratio'],bins=cut_cur,labels=woe_cur)

data['Num_of_Delayed_Payment'] = pd.cut(data['Num_of_Delayed_Payment'],bins=cut_ndp,labels=woe_ndp)

data['Credit_History_Age'] = pd.cut(data['Credit_History_Age'],bins=cut_cha,labels=woe_cha)

data['Num_of_Loan'] = pd.cut(data['Num_of_Loan'],bins=cut_nol,labels=woe_nol)

data['Age'] = pd.cut(data['Age'],bins=cut_age,labels=woe_age)

data['Num_Credit_Card'] = pd.cut(data['Num_Credit_Card'],bins=cut_ncc,labels=woe_ncc)

data['Num_Bank_Accounts'] = pd.cut(data['Num_Bank_Accounts'],bins=cut_nba,labels=woe_nba)

df = data[['Target','Credit_Utilization_Ratio','Num_of_Delayed_Payment','Credit_History_Age',

'Num_of_Loan','Age','Num_Credit_Card','Num_Bank_Accounts']]

# df.to_csv(r"D:\new_job\KAGGLE\kaggle\train_4_woe.csv")

'''查看iv列表'''

df = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train_4_woe.csv")

ivDf = pd.DataFrame(columns=['feature','iv'])

feaList = list(df.columns[1:])

ivList = [iv_cur,iv_ndp,iv_cha,iv_nol,iv_age,iv_ncc,iv_nba]

for i,x in enumerate(feaList):

ivDf.loc[i,'feature'] = x

ivDf.loc[i,'iv'] = ivList[i]

ivDf = ivDf.sort_values(by='iv',ascending=False).reset_index(drop=True)

print(ivDf)

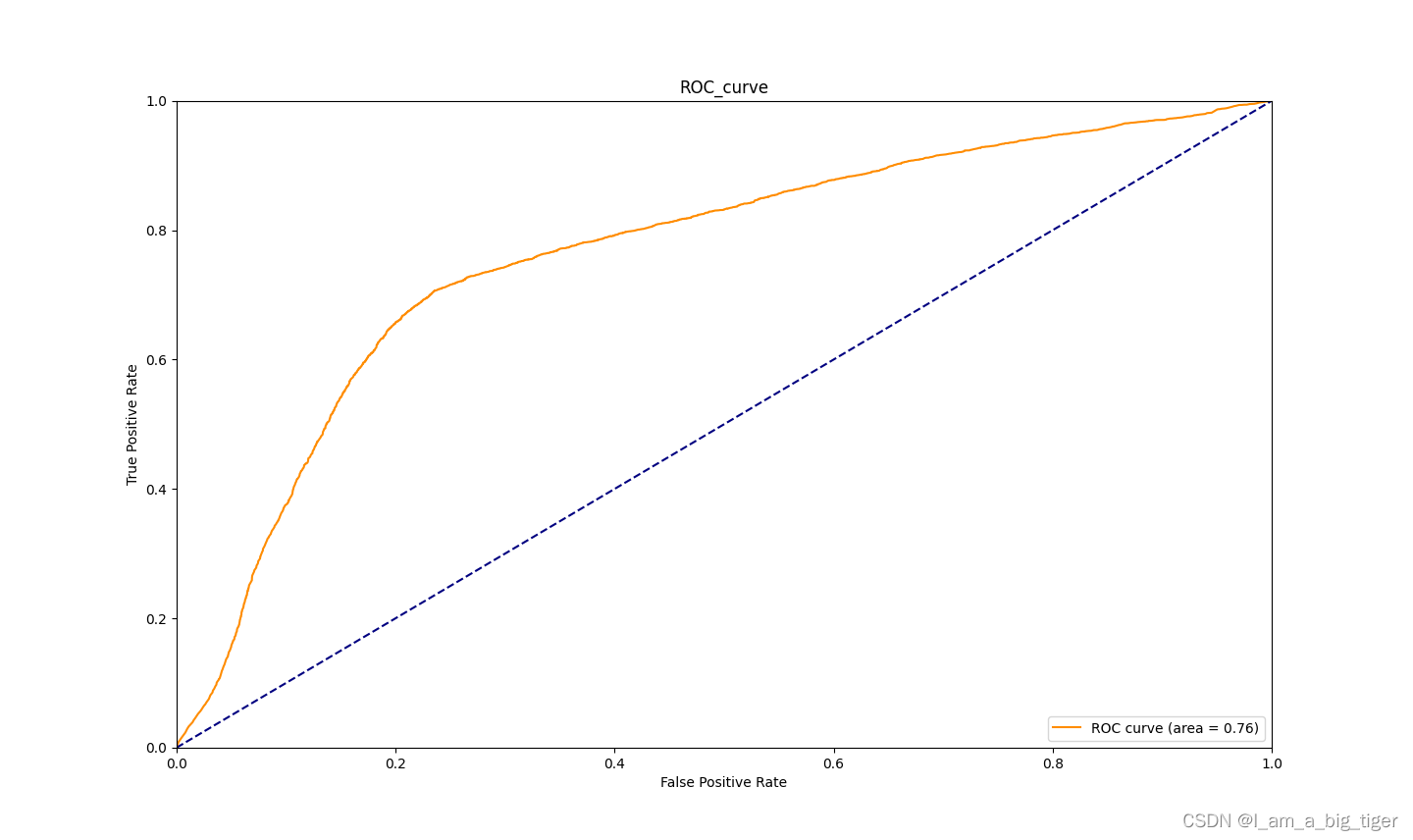

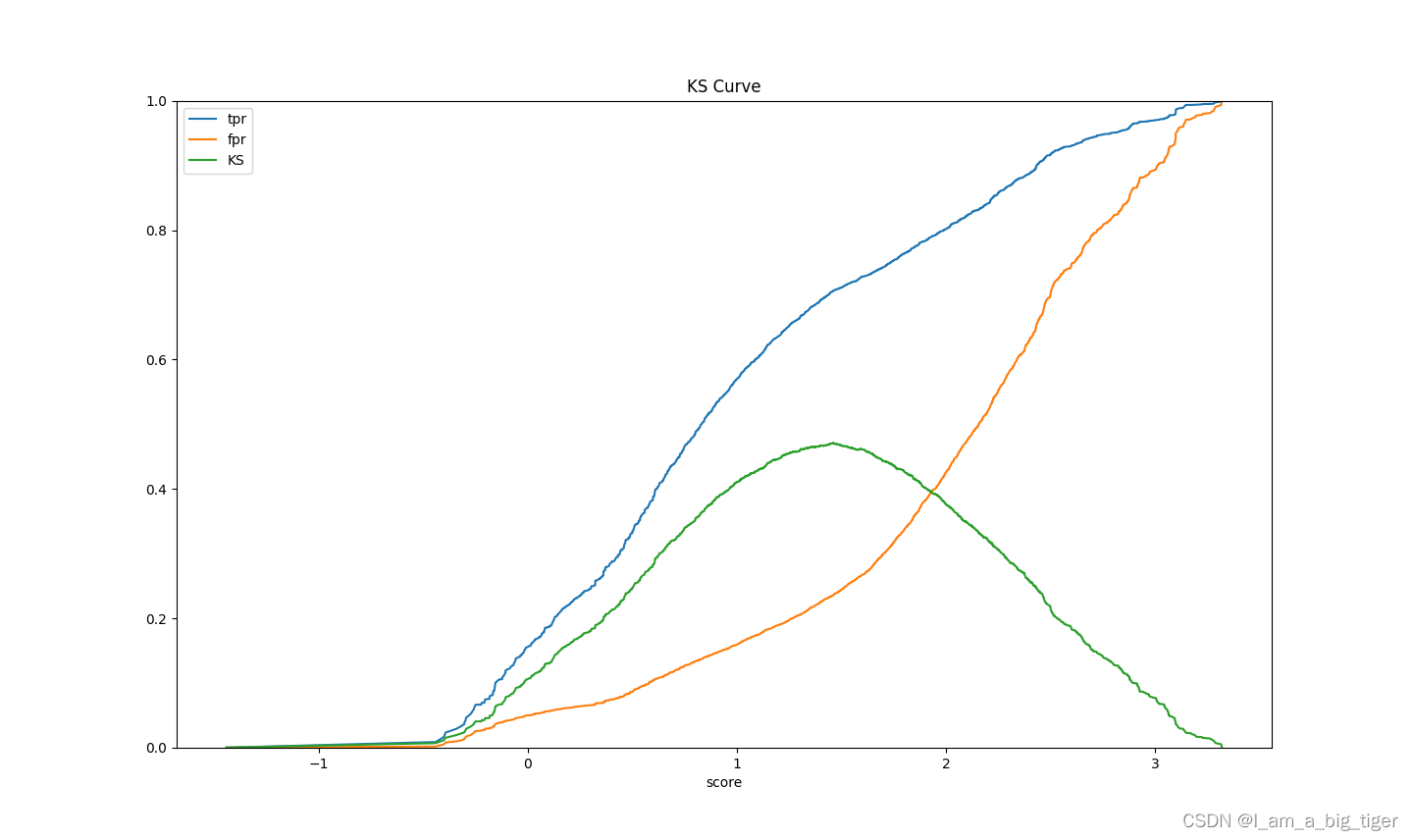

# ivDf.to_csv(r"D:\new_job\KAGGLE\archive\ivDf.csv")四、变量入模训练,auc=0.76,ks=0.47

from sklearn.linear_model import LogisticRegression

from sklearn.metrics import auc,roc_curve

from sklearn.model_selection import train_test_split

'''

LogisticRegression 一些重要参数的默认值

penalty:正则化类型,默认值'L2',当solver='liblinear'时,还可以选择‘l1’

tol:迭代终止的阈值,默认值为le-4

max_iter:最大迭代次数,默认值为100

'''

'划分训练集和测试集'

df = pd.read_csv(r"D:\new_job\KAGGLE\kaggle\train_4_woe.csv")

X = df.iloc[:,1:]

Y = df.iloc[:,0]

X_train,X_test,Y_train,Y_test = train_test_split(X,Y,test_size=0.3,random_state=0)

'模型训练'

lr = LogisticRegression(random_state=0,solver='liblinear',class_weight={0:0.4,1:0.6},penalty='l1')

k_train = lr.fit(X_train,Y_train)

'模型预测'

Y_pred = k_train.predict(X_test)

Y_score = lr.decision_function(X_test)

'''模型结果评估'''

fpr1,tpr1,threshold = roc_curve(Y_test,Y_score)

auc_value = auc(fpr1,tpr1)

#画图

plt.figure(figsize=(20,15))

plt.plot(fpr1, tpr1, color='darkorange',label='ROC curve (area = %0.2f)' % auc_value)

plt.plot([0, 1], [0, 1], color='navy', linestyle='--')

plt.xlim([0.0, 1.0])

plt.ylim([0.0, 1.0])

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.title('ROC_curve')

plt.legend(loc="lower right")

plt.show()

print('AUC值:',auc_value)

'计算KS值'

fig, ax = plt.subplots()

ax.plot(1 - threshold, tpr1, label='tpr') # ks曲线要按照预测概率降序排列,所以需要1-threshold镜像

ax.plot(1 - threshold, fpr1, label='fpr')

ax.plot(1 - threshold, tpr1-fpr1,label='KS')

#画图

plt.xlabel('score')

plt.title('KS Curve')

plt.ylim([0.0, 1.0])

plt.figure(figsize=(20,20))

legend = ax.legend(loc='upper left')

plt.show()

print('KS值:',max(tpr1-fpr1))五、模型AUC=0.76、KS=0.47效果。

更多推荐

已为社区贡献1条内容

已为社区贡献1条内容

所有评论(0)